Schedule C Deductions 2024 Worksheet – The 2024 tax season begins on January 29 and ends When filing their return and Form 1040, taxpayers can itemize their deductions or choose the standard deduction offered by the tax agency. . Here are the standard deduction amounts for the 2023 tax returns that will be filed in 2024. Taxpayers who are 65 and older, or are blind, are eligible for an additional standard deduction. .

Schedule C Deductions 2024 Worksheet

Source : www.betterwithbenji.comSchedule c expenses worksheet: Fill out & sign online | DocHub

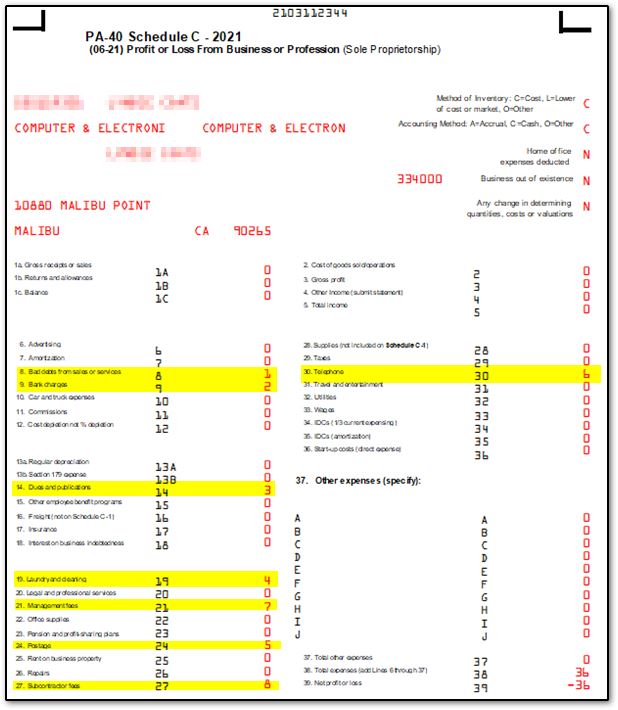

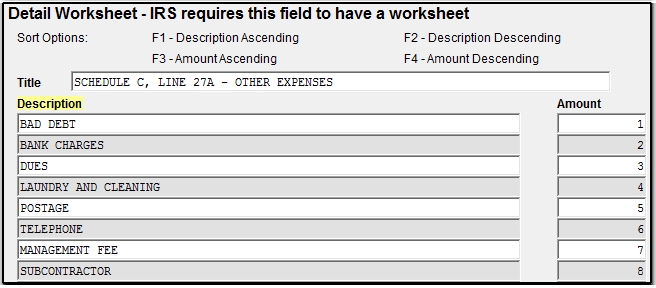

Source : www.dochub.comPA Schedule C Expenses (ScheduleC)

Source : drakesoftware.comSchedule c expenses worksheet: Fill out & sign online | DocHub

Source : www.dochub.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govReal Estate Agent Tax Deductions Worksheet Pdf Fill Online

Source : real-estate-agent-tax-deductions.pdffiller.comPA Schedule C Expenses (ScheduleC)

Source : drakesoftware.comEmployee’s Withholding Certificate

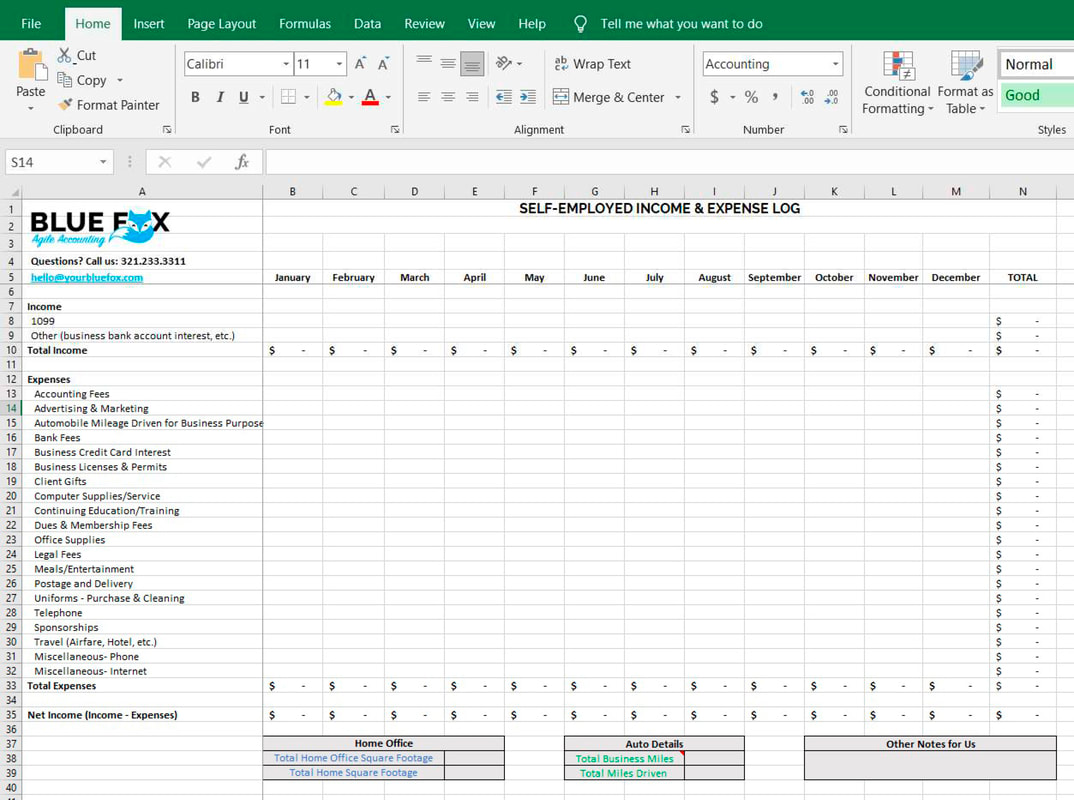

Source : www.irs.govFree Download: Schedule C Excel Worksheet for Sole Proprietors

Source : www.yourbluefox.comWhat do the Expense entries on the Schedule C mean? – Support

Source : support.taxslayer.comSchedule C Deductions 2024 Worksheet Free Business Expense Tracking Spreadsheet (2024): If you’ve yet to file your taxes, here’s why you may want to hold off if you’re claiming the child tax credit this year. . Itemized deductions (Schedule A), deductions and expenses from freelance or self-employed work (Schedule C), or HSA distributions (1099-SA). $0 + $0 per state filed. It allows you to file a 1040 f .

]]>