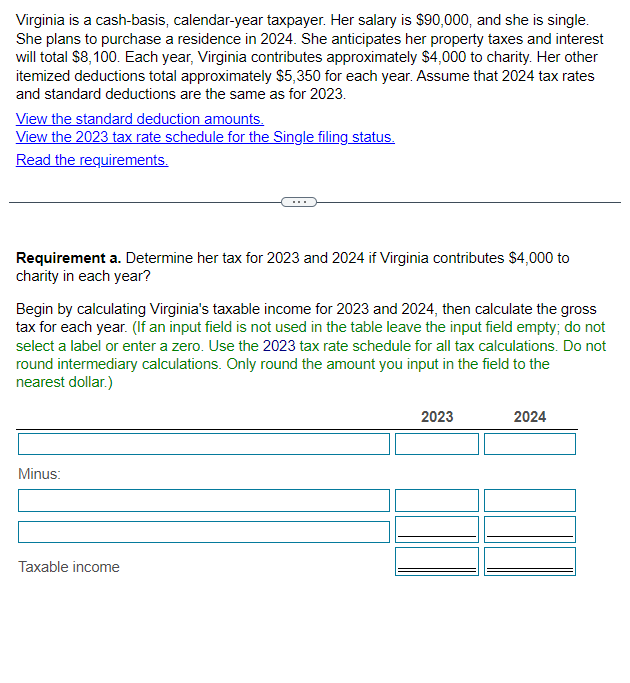

Schedule A Itemized Deductions 2024 Calendar – WealthUp Tip: Federal tax returns for the 2023 tax year are due April 15, 2024 (April take the standard deduction, you can’t claim any itemized deduction found on Schedule A. . With tax season underway, you’ll need to know the standard deduction amount you can claim for 2023. The standard deduction amounts tend to increase slightly each year to adjust for inflation. Let’s .

Schedule A Itemized Deductions 2024 Calendar

Source : www.chegg.comWhat Is Schedule A? | H&R Block

Source : www.hrblock.comTax Calculator: Income Tax Return & Refund Estimator 2023 2024

Source : www.hrblock.com2024 Personal Finance Calendar

Source : www.investopedia.comIRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.orgWhat Is Schedule A? | H&R Block

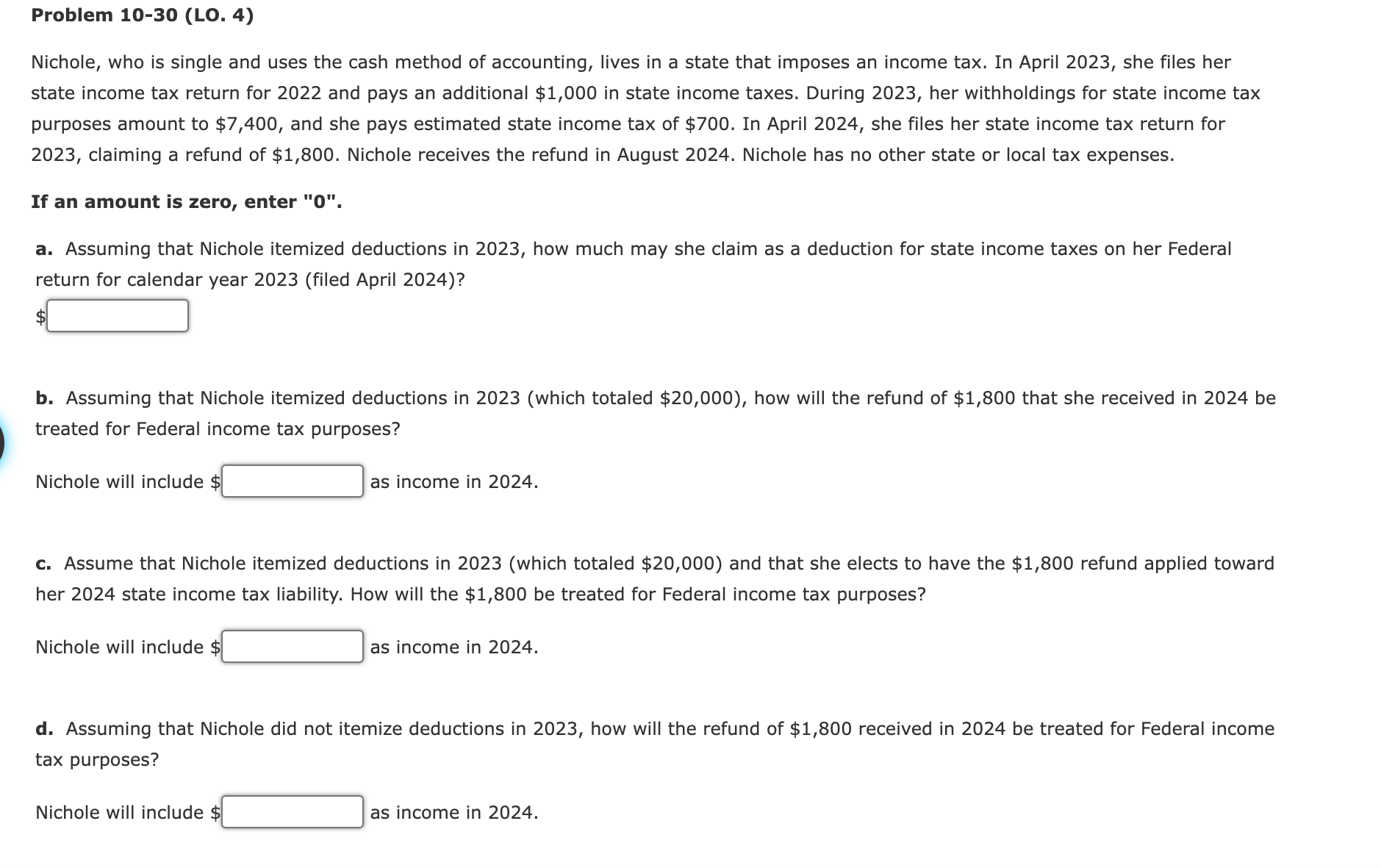

Source : www.hrblock.comSolved Nichole, who is single and uses the cash method of | Chegg.com

Source : www.chegg.comHorsesmouth: 2024 Retirement Calendar Checklist

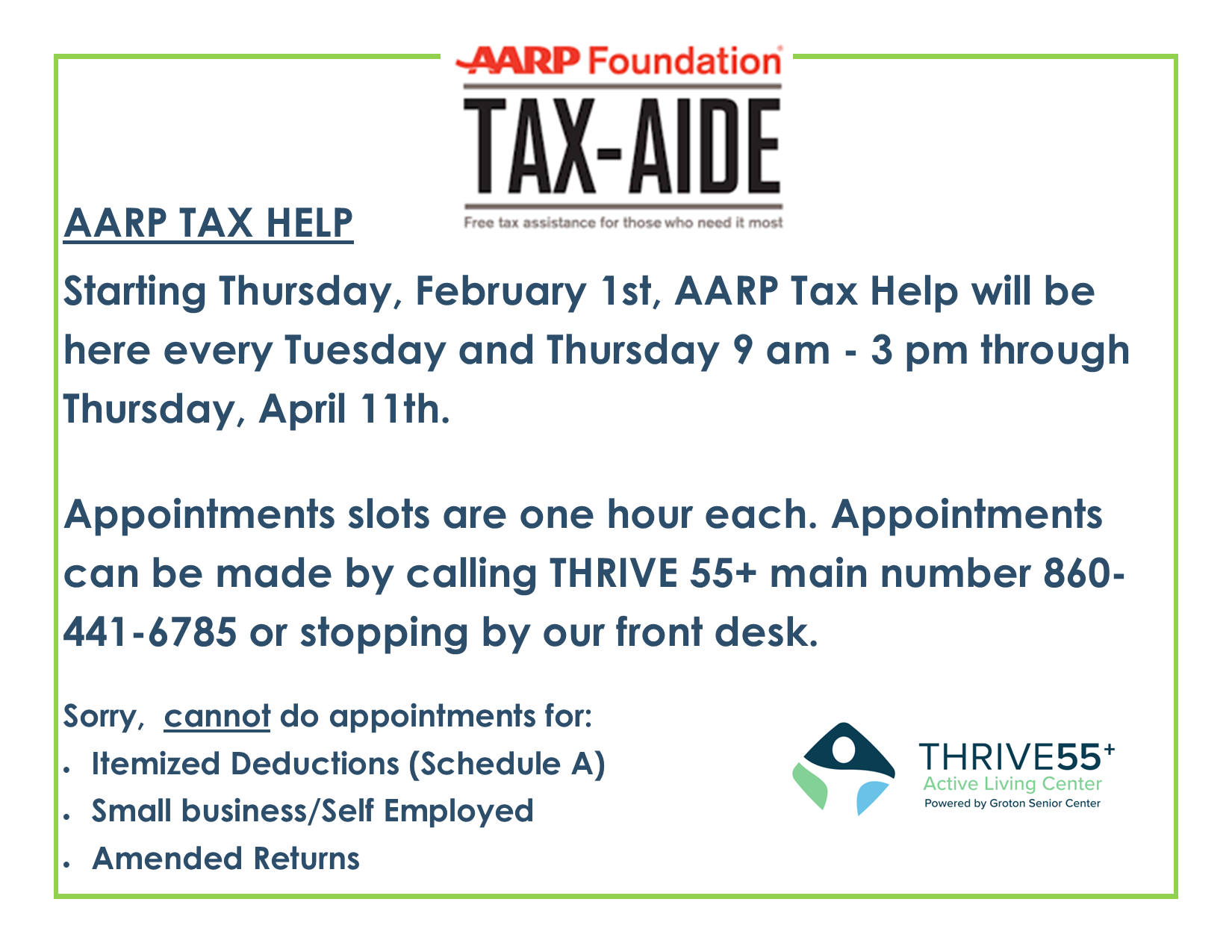

Source : www.horsesmouth.comAARP TAX HELP 2024 at Thrive55+ Senior Centers

Source : seniorcenterct.org2024 Personal Finance Calendar

Source : www.investopedia.comSchedule A Itemized Deductions 2024 Calendar Requirements Determine her tax for 2023 and 2024 for | Chegg.com: To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are . Information about SALT taxes and other possible itemized deductions is input into Schedule A on the return. These potential deductions include: The amount paid for state income taxes or sales taxes. .

]]>

:max_bytes(150000):strip_icc()/12December2024-8648b9b410ef4eb2b9a992876ba31b00.jpg)

:max_bytes(150000):strip_icc()/04April2024-34134fa17a094e71a3c1d674c850fa00.jpg)